Do you know exactly how big the market size is for your ecommerce business?

How about the socioeconomic, geographic, and internal makeup of your ideal customers?

If you answered “no” to one or both of the questions above… You’re not alone!

Ecommerce market research is one of the most important aspects of a successful go-to-market strategy, yet so many businesses fail to do the work (and they end up paying for it in the long run).

That’s why today I’m going to show you how to complete detailed ecommerce market research for your business, product, or idea. This guide will not only provide the tools and data you’ll need to be successful, but will also provide actionable takeaways you can use to grow and improve your ecommerce business.

Let’s do this!

The Ecommerce Market Landscape (Overview)

It’s hard to believe that Amazon turned 25 years old in 2018.

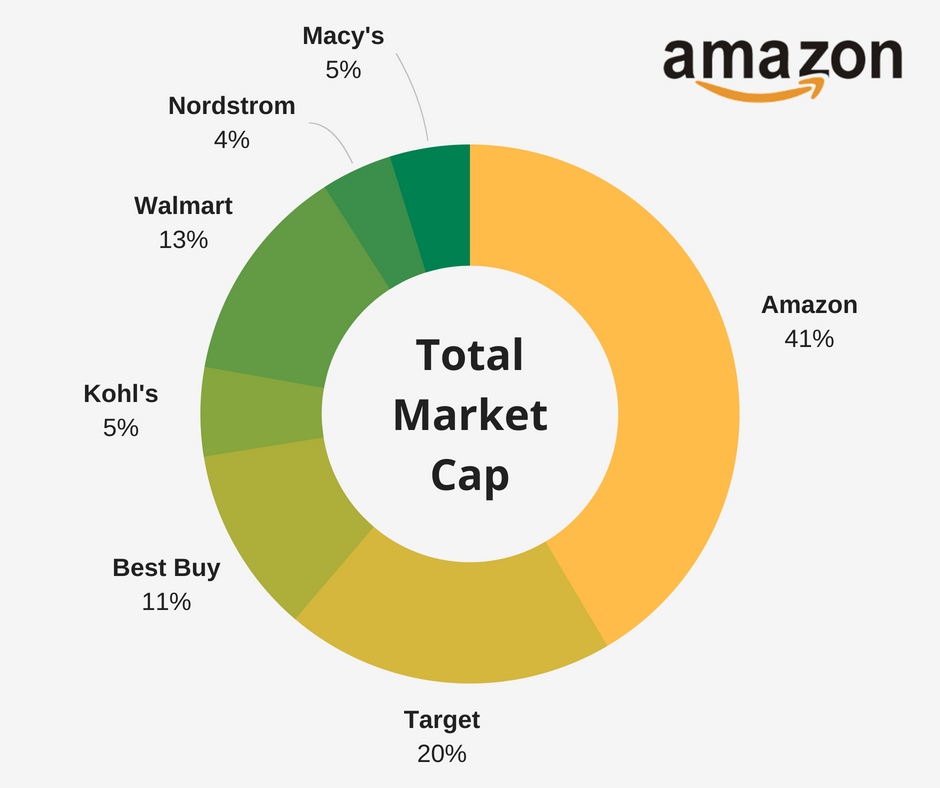

Now with a market value of $777.8 billion, Amazon is the poster child for the entire industry — leading us into a very bright ecommerce future.[*]

Even with Amazon grabbing 4% of all retail sales in 2017 and projected to account for 50% of the U.S. ecommerce retail market by 2021, both Amazon and the ecommerce industry in general are still poised for massive growth.[*]

What fantastic news for you and me!

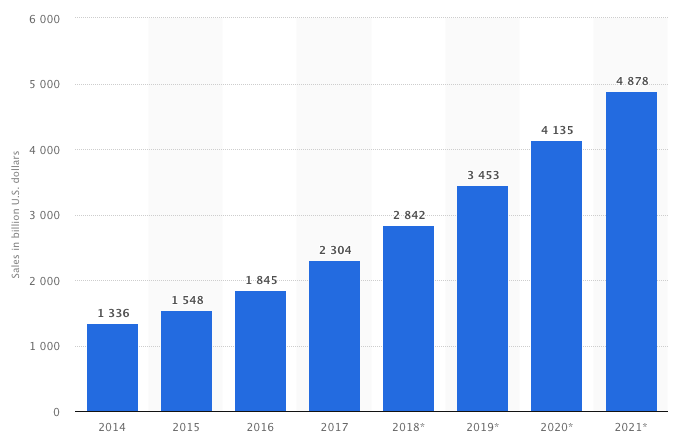

The potential growth for global ecommerce is astounding.

In 2017, nearly 1.66 billion people worldwide purchase products online, amounting to 2.3 trillion U.S. dollars.

But it doesn’t stop there. Projections show a growth of up to 4.48 trillion U.S. dollars by 2021.[*]

One of the reasons that this trend is only just getting started is because younger generations prefer online shopping to traditional brick-and-mortar stores.

Get this… 67% of Millennials and 56% of Generation X prefer to shop online rather than in-store, each combining to make up a big portion of the U.S. ecommerce market.[*]

The problem is, however, that these are all just a bunch of big numbers.

Unless you truly understand how to break these numbers down, identify a target market segment, analyze the market opportunity, and sell your product directly to a willing customer, you’ll find yourself continuing to wonder how to get in on the action.

That’s where ecommerce market research is crucial.

What Is Ecommerce Market Research?

There are hundreds of definitions out there for what market research really is, and how it can help your online business.

But market research doesn’t have to be complicated. At the end of the day, it’s all about discovering exactly what your customers want from you.

More technically speaking, Shopify defines market research as consisting of “systematically gathering data about people or companies — a market — and then analyzing it to better understand what that group of people needs.”[*]

In other words:

Market research gives you both a qualitative and quantitative understanding of why your ideal customers would want to buy your products.

The great thing about market research is that it mixes science with intuition.

Your gut might be telling you one thing, but the data is telling you something different. You must synthesize all of this information and make the right decision for your business.

But don’t worry, I’ll show you how.

First, it’s important to understand that there are two types of research and dozens of tools to help you research.

-

Primary Research: Data and information that you collect yourself. You control and own the method of collection as well as the data itself.

-

Secondary Research: Data or information that you collect from existing sources. You can analyze the data in any way you want, but the information is also available to other people (and your competitors).

-

Tools: Anything you use to collect, gather, organize, and analyze data and information through primary or secondary research. For example, surveys, focus groups, interviews, observations, publications, magazines, government reports, institutional research, and more.

The purpose of collecting in-depth information is to help you make better decisions.

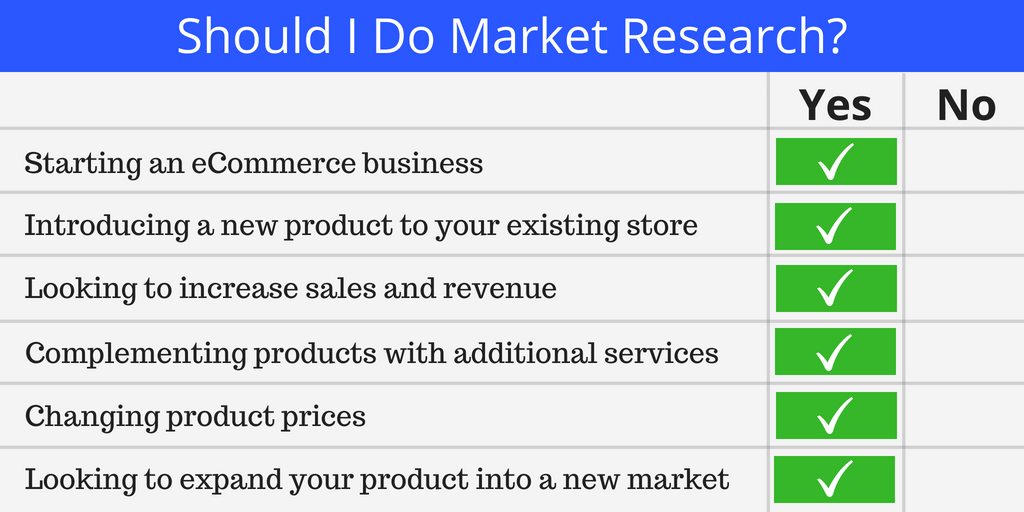

You should be conducting market research if you’re:

Let’s get into the specifics on how to do ecommerce market research the right way, and how to apply it to your business.

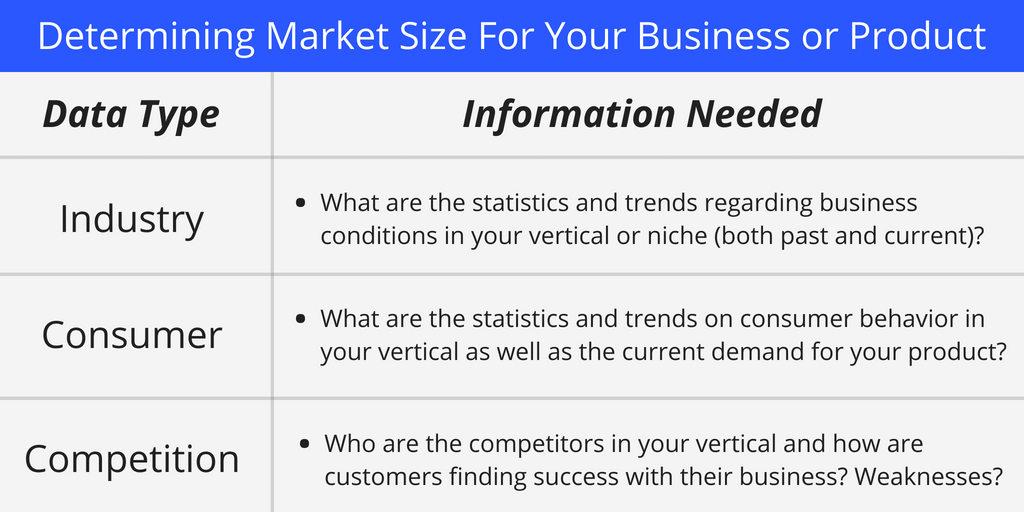

Determining The Market Size For Your Business Or Product

The first step in every ecommerce market research journey is to determine the potential market size for your business or individual products.

For this section, let’s say that you’re a brand-new online retailer specializing in clothing and gear for women and men. You’re looking to launch a new line of women’s active clothing and apparel.

Great. Now what?

First, you’ll need to determine several key pieces of information:

Step 1: Analyzing Your Industry

The ideal industry market research report should ultimately allow you to describe your industry’s current size, growth rate, and trends.

This is the easiest of the three steps because there are hundreds of data-backed studies and articles published online about specific industry sizes, growth rates, and trends every year.

Here are just a few of the major sources of reliable industry information:

-

Nielsen: A leading global information and measurement company, provides market research, insights and data about what people watch, listen to and buy.[*]

-

Pew Research Center: A fact tank that informs the public about the issues, attitudes and trends shaping America and the world.[*]

-

MarketResearch.com: A leading provider of market research reports and industry analysis on products, markets, companies, industries, and countries worldwide.[*]

-

U.S. Census Bureau: One of America’s leading sources of quality data about people, business, and economy.[*]

-

NPD Group: Industry analysis and advisory services help retailers identify market trends to make smarter business decisions.[*]

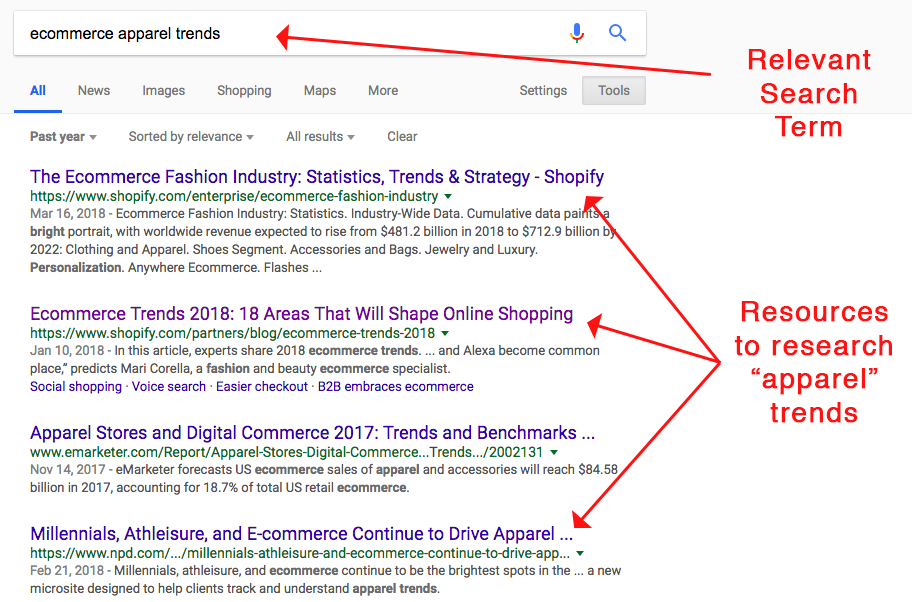

Continuing with our women’s active clothing and apparel example from above, you’ll want to find and read as many industry articles as you can. Google is a great place to start your search. As shown below, I searched for the term ecommerce apparel trends, selected Tools on the top right of the page, and then changed the search timeframe to Past year:

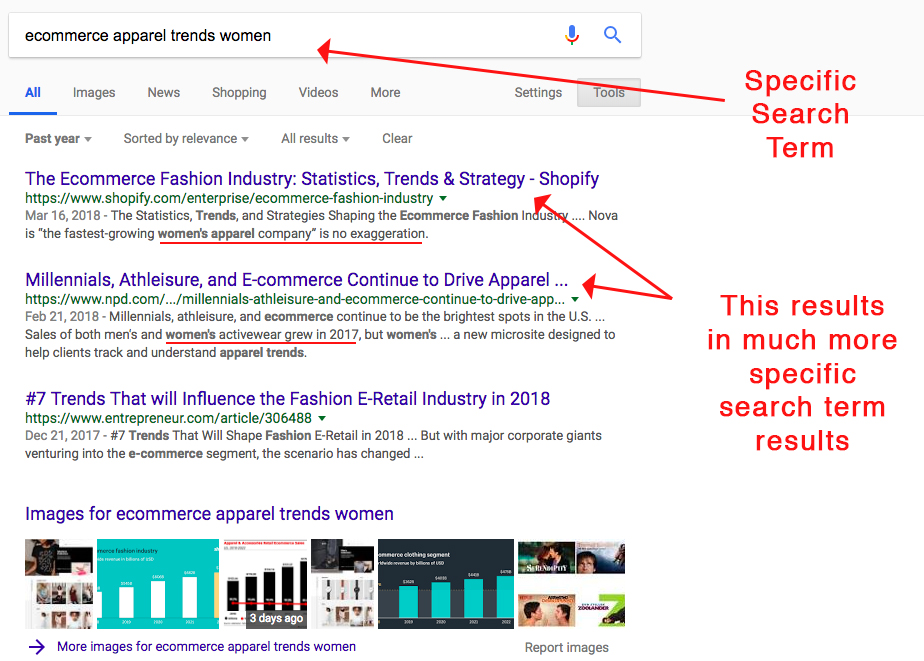

That’s helpful, but a non-specific search term might be too general if you’re looking to launch a new line of clothing for women (and might skew the data). Try refining your search — the more specific data you can find, the better:

Now we’re getting somewhere!

According to NPD Group, “Sales of both men’s and women’s activewear grew in 2017, but women’s supplied much of the energy behind the category’s growth, reaching $21.9 billion in sales with a 4 percent increase over 2016.”[*]

Use this market research template to analyze your industry

Now that we know there’s a market for your product, it’s time to find out exactly who your ideal customers are, where they’re located, and what makes them buy.

Step 2: Understanding Your Consumer

Once you have a solid knowledge of the size of your industry, key trends, and where it is headed in the future, it’s time to do some very important work in the way of consumer research.

As I mentioned before, this entails understanding the socioeconomic, geographic, and internal makeup of your ideal customers.

Here’s how to find that information.

Consumer Surveys

There is absolutely no better way to understand your ideal customer than to ask (primary research) the people who will actually buy your product.

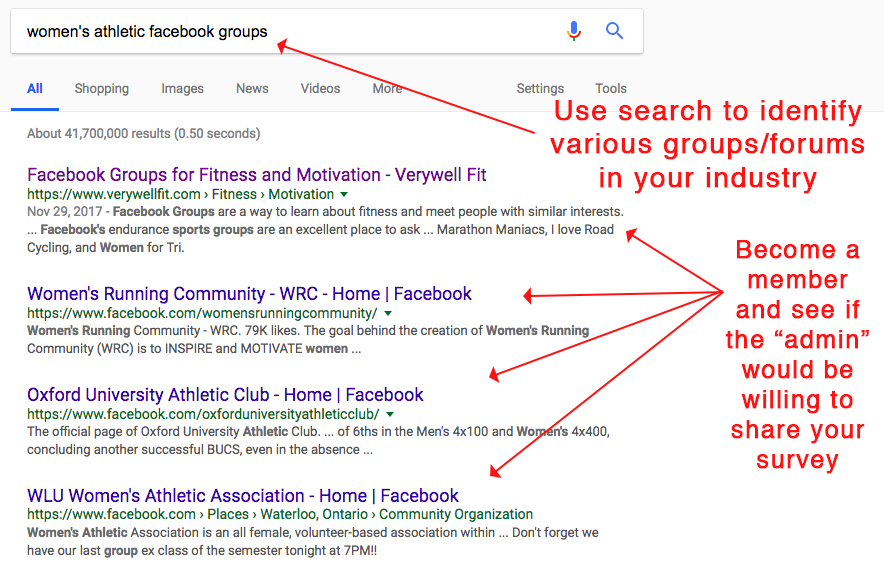

Going back to the women’s active clothing and apparel example, you might start with relevant online forums, Facebook Groups, Slack channels, social media channels, or even people in your direct network.

As with most research, start in your favorite search engine:

Join as many relevant groups or forums as you can, and ask each admin if they might be willing to share your survey.

There are lots of free tools you can use to conduct customer surveys, such as Google Forms and TypeForm (which are particularly helpful if you have an engaged audience, such as an active email list or social following).

Or, if you’d like to get the survey out to more people, you can pay for a service like Google Surveys, which also allows you to target specific user segments to get more specific insights.[*]

Your survey should ask questions such as: age, location, income, favorite brands, favorite colors, where they shop, and where they typically buy clothing. The more you can find out, the better!

Consumer Reports

Consumer reports will help to supplement all the primary research you’re doing with consumer surveys, and provide you with a general scope of purchasing behavior for your target customer.

Again, the key is to be as specific as possible in your online searches. Instead of searching for a term such as “women’s shopping trends,” try searching for something like “women’s shopping behavior and consumer insights 2018.”

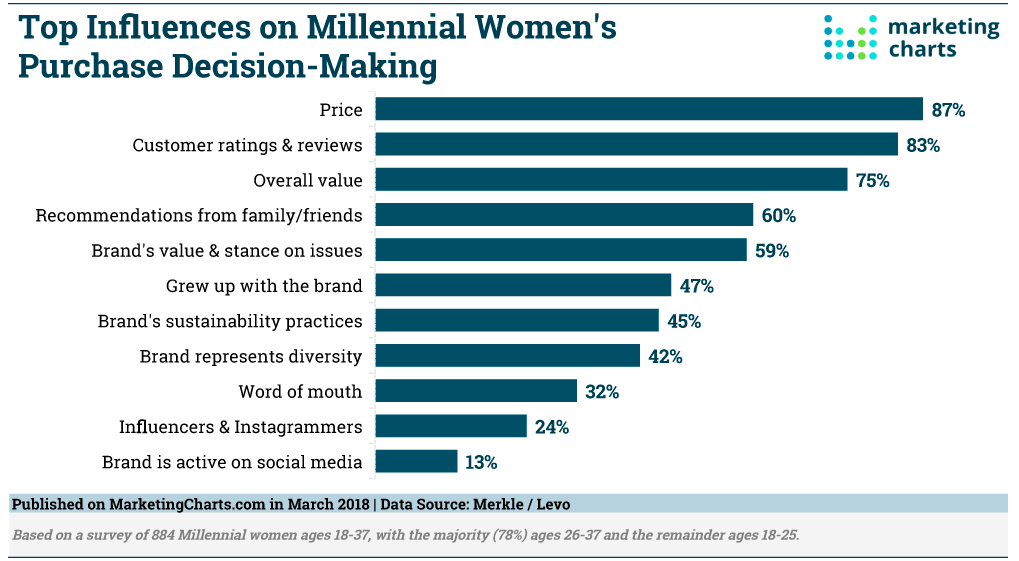

Specific searches lead to some incredible insights, such as this Why Women Buy research from Merkle:[*]

Now, you have some specific, actionable data from more than 887 women aged 18-37 that you can immediately apply to your product or service.

For example, you could run a series of successful Instagram advertisements using this knowledge to shape the type of creative you use, the headline you write, and the call to action.

Your Instagram ad might include a headline that mentions Price (based on your consumer report research), and a caption that shows a real customer review or testimonial. Or, since you know that Recommendations from family/friends are important to your target audience, you could run an influencer marketing campaign to help increase conversions and sales to your product.

Facebook Audience Insights

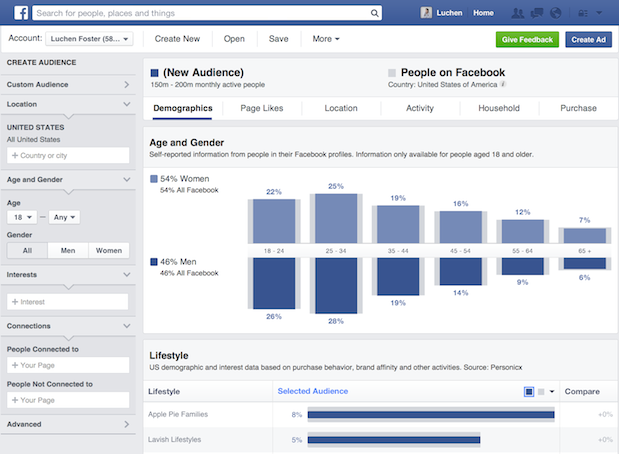

Quite possibly the most underrated ecommerce market research tool available is Facebook Audience Insights.[*]

If you have a Facebook Business Page, you can use their free audience insights tool to understand who your followers are.

The tool provides useful information such as their age, income, lifestyle (as determined by Facebook), spending behavior, and more. The location insights are especially helpful for brick and mortars.

In this case, we’re looking to understand consumer behavior for a women’s clothing and apparel brand. Filtering for “women”, “ages 18+”, and interested in “shopping and fashion” returns some interesting results.

You can instantly see all the top Facebook Pages that this demographic is interested in, including the #1 clothing store on Facebook, The Mint Julep Boutique.

At that point, it’s time to do some competitive analysis. Study The Mint Julep Boutique across social media and find out what they’re posting. Understand on a deep level what’s working for them and what’s not and look to replicate their successes.

Also, targeting fans and followers of The Mint Julep Boutique with Facebook ads is a great way to get in front of an audience that is most likely to buy your product.

Every new nugget of information found within these customer research tools provides another avenue for data discovery. Be patient, be specific, and chase down every lead!

Use this market research template to understand your consumer

Step 3: Researching Your Competition

If you’re looking for an industry without competition, you’re out of luck. In fact, you may not want to be looking there at all…

CEO and startup founder, Chris Meyers, explains why in a recent Forbes article:[*]

“The absence of competition in any given market segment is often viewed as a positive by entrepreneurs, providing them with a clear and straightforward path to success.

This belief, however, is as damaging as it is misguided. Entrepreneurs who don’t have competition should be wary. Rather than being a strength, a lack of competition in your market can be indicative of a serious weakness.”

You read that correctly. A lack of competition can mean a variety of negative things for your ecommerce business, including too narrow of a focus or that the market isn’t ready for your product yet…

Remember those old handheld devices called PalmPilots? Of course you don’t… Cell phones completely wiped them off the market.

In the case of women’s clothing and apparel, competition is stiff![*]

And those are only a fraction of the hundreds of products out there competing for your customers.

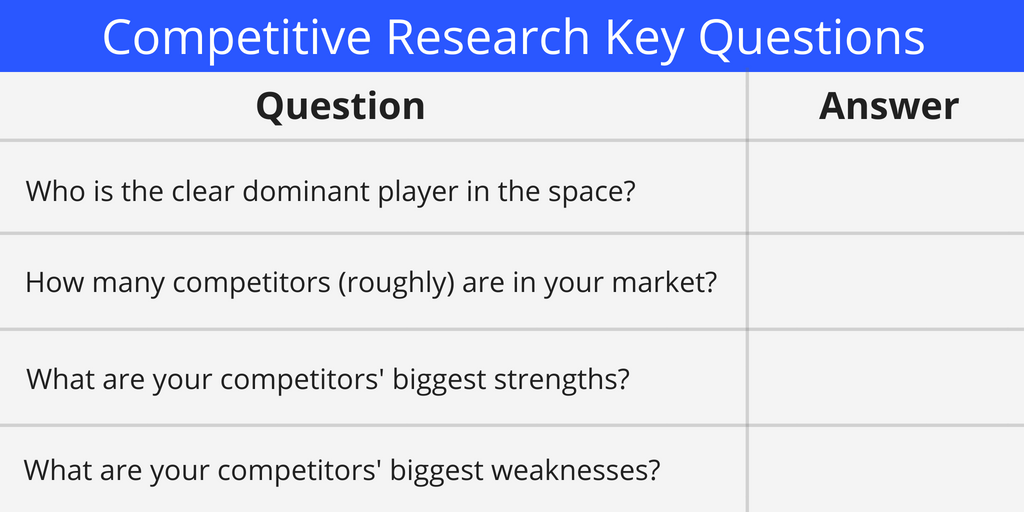

Therefore, consider researching your competition as a necessary and vital part of the journey. Here are a couple of questions you should be asking when you get started:

Once you have a solid understanding of each of the four questions above, it’s time to put that knowledge to use. This is where the rubber meets the road.

From the answers above, create a long list of product ideas that you think would 1) serve customers better than the current competition, and 2) would be compelling enough for a customer to switch over to your product from top competitors.

Once you have the list of solid product ideas the only way to find out if they are valid is to see if real people are willing to buy it. The 80/20 validation method is one of my favorite ways to test an idea without spending a ton of money. Validating your product idea is an absolutely must-do step in this process.

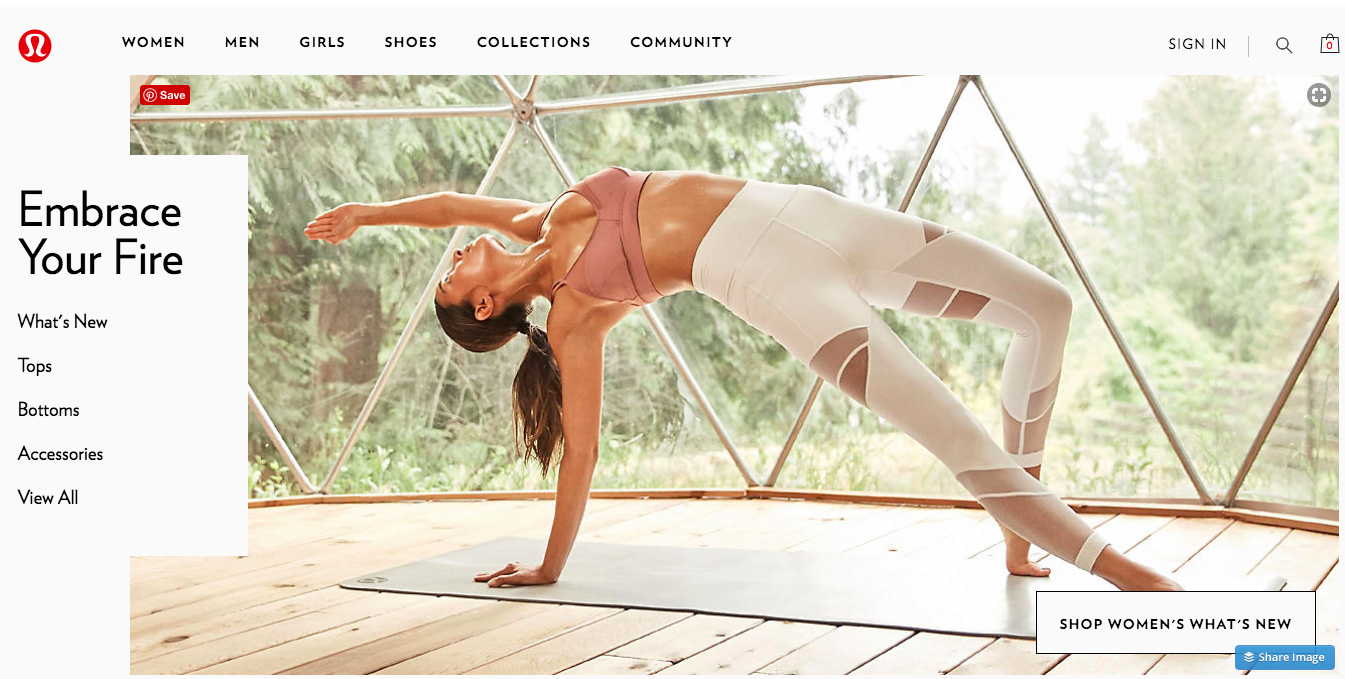

Take Lululemon, for example. Early on, they tested their products religiously with actual yoga teachers before realising many products to the public.[*]

And Lululemon is in an industry that some would argue is over-saturated and highly competitive. How did they still manage to carve out a $1 billion+ business?

I believe it’s because they studied their competition relentlessly and determined that there was a gap in the market that they could fill.

Today, Lululemon is making their shareholders incredibly wealthy by selling super high-quality athletic apparel… with a particular focus on yoga.

Yoga is large enough of an industry to where they can be extremely profitable, yet not too large to where they have no idea who their target customer is.

Now that’s ecommerce market research at its finest!

Use this market research template to research your competition

3 Key Ecommerce Market Research Takeaways

-

Analyze Your Industry

-

Understand Your Consumer

Research Your Competition

What are the statistics and trends regarding business conditions in your vertical or niche (both past and current)? The more specific data you can find around your particular industry, product or service, the better. Scour search engines until you find real, concrete data that you can use to make informed decisions.

This entails understanding the socioeconomic, geographic, and internal makeup of your ideal customers. Use all the free tools at your disposal such as consumer surveys, consumer reports, and Facebook Audience Insights to build detailed customer profiles of real people that will actually buy your product. Record important data such as age, income, lifestyle (as determined by Facebook), spending behavior, and more.

Remember, rather than being a strength, a lack of competition in your market can be indicative of a serious weakness. Consider researching your competition as a necessary and vital part of the journey. Is there a clear dominant player in the space? What is their biggest strength? What is their biggest weakness?

To help you do market research for your business, we’ve put together an ecommerce market research template. Click the button below to download it and fill in the blanks.

Add A Comment

VIEW THE COMMENTS